Debt Consolidation

Fresh Start Loan

This loan provides debt consolidation and relief by converting high-interest debt into a 0%-interest loan.

This loan provides debt consolidation and relief by converting high-interest debt into a 0%-interest loan.

The Fresh Start Loan Program provides 0%-interest, no-fee loans of up to $20,000 to clients working with select financial counseling organizations as a means to pay down high-interest debt and regain financial stability.

To be eligible for a Fresh Start Loan, you must be working with and referred by a financial counselor at one of the organizations listed below. Please contact one of the organizations directly if you wish to begin working with a financial counselor.

Bedford-Stuyvesant Restoration Corporation (Restoration Plaza)

Serving residents of Brooklyn

Contact: Earlene Greene, Manager, Financial Counseling/Coaching Programs

Email: financialempowerment@restorationplaza.org

Phone: 929-432-3332

Neighborhood Trust Financial Partners (NTFP)

The Community Service Society of New York (Financial Coaching Corps)

Serving residents of NYC’s five boroughs

Contact: Robi Jaffrey

Email: rjaffrey@cssny.org

New York Legal Assistance Group (NYLAG)

Serving residents of NYC’s five boroughs

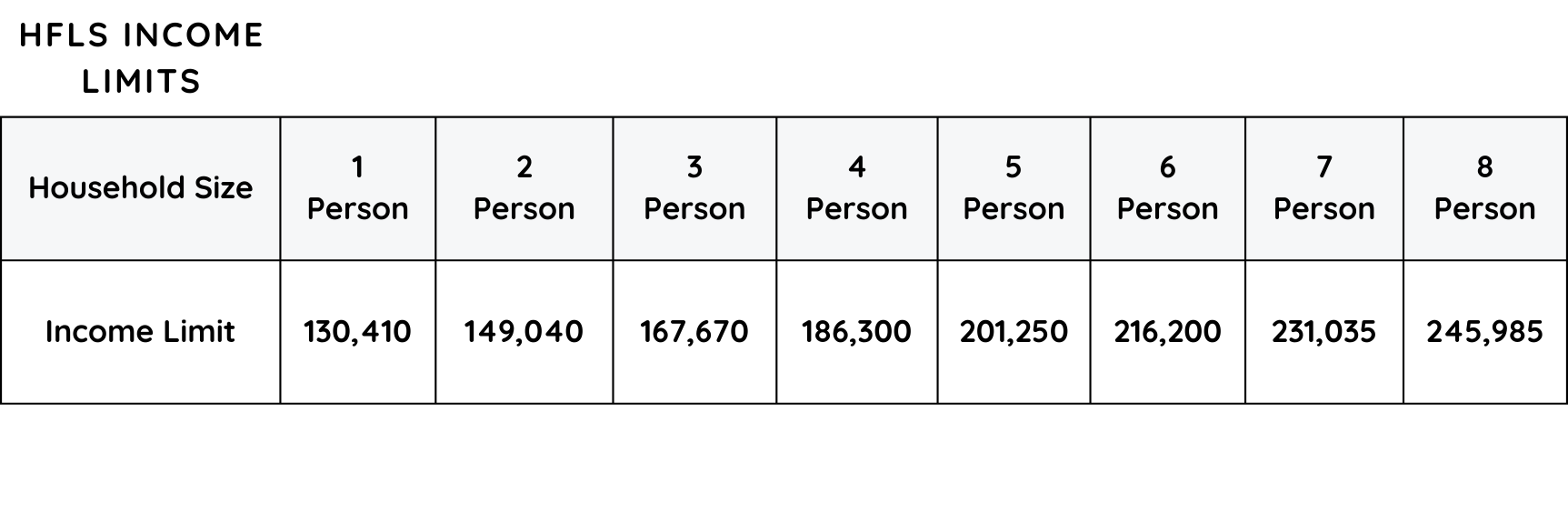

In addition to working with a financial counselor at one of the organizations listed above, loan applicants must meet the following general HFLS eligibility criteria:

Please do NOT contact HFLS with questions regarding the Fresh Start Loan Program, as HFLS cannot provide you with the online application or determine whether you are eligible. The financial counselor you work with will be able to determine your eligibility for a Fresh Start Loan after reviewing and discussing your financial situation with you. If you are eligible, they will provide you with additional information and a link to an online application.

After receiving the completed application, required documents, guarantor form(s), and ID-Pal verifications, an HFLS Loan Officer will contact you to request any missing information and schedule a 15-minute loan interview by phone.

During the interview, the Loan Officer will ask any questions they have about your application, explain the loan closing process and loan terms, and answer any questions you have.

Due to the high volume of applications, we ask that you do NOT contact HFLS about the status of your application. HFLS reviews complete applications only in the order in which they are received. If you have not heard from a Loan Officer, it is because one or more of the steps above is not complete or because HFLS is processing applications that were completed before yours.