Citizenship Loans

Interest-free loans to pay U.S. citizenship application fees.

Interest-free loans to pay U.S. citizenship application fees.

The Citizenship Loan Program, in partnership with the organizations listed below, provides interest-free loans to low- and moderate-income residents of New York City’s five boroughs, Westchester, or Long Island to cover naturalization application and related fees for themselves and/or family members.

HFLS Citizenship Loans have no fees, and there is no interest charged; borrowers repay exactly the amount they have borrowed.

Since HFLS lends to households, a married couple is considered one borrower. If an applicant is married or partnered, he or she must include their spouse’s/partner’s information in the application.

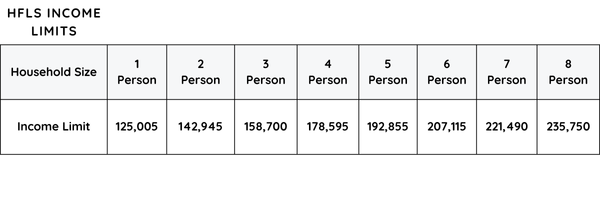

To qualify for a Citizenship Loan, applicants must:

Loan Amounts & Repayments

Loan Amounts & RepaymentsCitizenship Loans may be for any amount up to $1,500, and must be used by the applicant or a member of the applicant’s household to pay naturalization or related fees.

Citizenship Loans are repayable in equal installments over ten months. For example, if the loan amount is $725 (the cost of a naturalization application fee), the borrower will repay $72.50 per month over ten months. If a ten-month repayment term is not are not affordable, HFLS will work with the applicant to arrange for a lower monthly repayment amount and a longer loan term.

Loan repayments will begin two to three weeks after the applicant receives the final loan paperwork (see below). The first repayment date will be noted on the final loan documents that the applicant will sign before their loan is disbursed. Repayments will be made on either the 5th or the 20th of each month; the applicant will select their preference before HFLS disburses their loan.

After receiving the completed application, required documents, and ID-Pal verification, an HFLS Loan Officer will contact you to request any missing information and schedule a 15-minute loan interview by phone.

During the interview, the Loan Officer will ask any questions they have about your application, explain the loan closing process and loan terms, and answer any questions you have.

Due to the high volume of applications, we ask that you do NOT contact HFLS about the status of your application. HFLS reviews complete applications only in the order in which they are received. If you have not heard from a Loan Officer, it is because one or more of the steps above is not complete or because HFLS is processing applications that were completed before yours.

Apply for a Citizenship Loan Here

If you prefer to print a hard copy application, please email Loan@HFLS.org to request a PDF.