Mitchell-Lama Homeownership Loan

Loans for housing support the equity payment on a Mitchell-Lama apartment.

Loans for housing support the equity payment on a Mitchell-Lama apartment.

The Mitchell-Lama Homeownership Loan Program provides interest-free loans of up to $30,000 to lower-income residents of New York City’s five boroughs, Westchester, or Long Island to help purchase a Mitchell-Lama apartment.

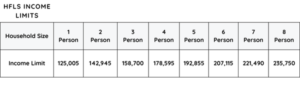

Loan applicants must have annual pre-tax household income at or below the income limits for their household size. If your annual pre-tax household income is slightly above the limit in the chart below, please contact Loan@HFLS.org to speak with a Loan Officer about your specific situation; you may still qualify for an HFLS loan.

Applicants must have received an official Mitchell-Lama closing letter listing the apartment’s purchase price and monthly maintenance and must submit this document to HFLS with their application. Loan amounts are up to $30,000 or the apartment’s purchase price, whichever is lower, and are repaid in installments of $500 per month (60 months for a $30,000 loan).

All loans have a one-month grace period before repayments begin. Repayments are made on either the 5th or the 20th of each month; borrowers select their preference before HFLS disburses the loan. All loan repayments are made by electronic debit of a checking account.

Since HFLS lends to households, a married couple is considered one borrower. If an applicant is married or partnered, he or she must include their spouse’s/partner’s information in the application.

Two guarantors are required for all loans, and both guarantors must complete and sign Guarantor Forms. A married couple is considered one guarantor. If a guarantor is married or partnered, his or her spouse/partner must also complete and sign the Guarantor Form.

Each guarantor is “jointly” and “severally” liable for the loan in the event a borrower is unable to pay for any reason. This means that, while HFLS would expect each guarantor to share equally in the responsibility of repaying the loan, each is liable legally for the full amount, and any one guarantor could be called upon to repay the balance due.

Guarantors must meet the following criteria:

Even if they meet the requirements above, the following people may not guarantee a loan:

From the borrower:

From the guarantors:

After receiving the completed application, required documents, guarantor form(s), and ID-Pal verifications, an HFLS Loan Officer will contact you to request any missing information and schedule a 15-minute loan interview by phone.

During the interview, the Loan Officer will ask any questions they have about your application, explain the loan closing process and loan terms, and answer any questions you have.Due to the high volume of applications, we ask that you do NOT contact HFLS about the status of your application. HFLS reviews complete applications only in the order in which they are received. If you have not heard from a Loan Officer, it is because one or more of the steps above is not complete or because HFLS is processing applications that were completed before yours.

HFLS reviews and decides on loan applications daily. If we have questions about your application or guarantor, you may receive a call or email from a Loan Officer asking for further information before HFLS will make its decision.

HFLS, in its discretion, may decline to make a loan, make a loan in an amount less than that requested, or require different or additional guarantors.

If your loan is approved, you will receive an email with loan closing documents for you to complete and sign electronically via DocuSign. The loan closing paperwork includes:

Once HFLS receives the electronically signed documents above, we will disburse your loan funds directly into your checking account within three business days. (Please note that it may take a few extra days after the disbursement for the loan funds to appear in your checking account.)